Increasing Teen Financial literacy about credit cards with PNC bank

Team Size

5 members

Duration

9 weeks

Role

Design Lead and Researcher

Skills

- Service Blueprint

- Stakeholder mapping

- Modelling

- Storyboarding & Speed-dating

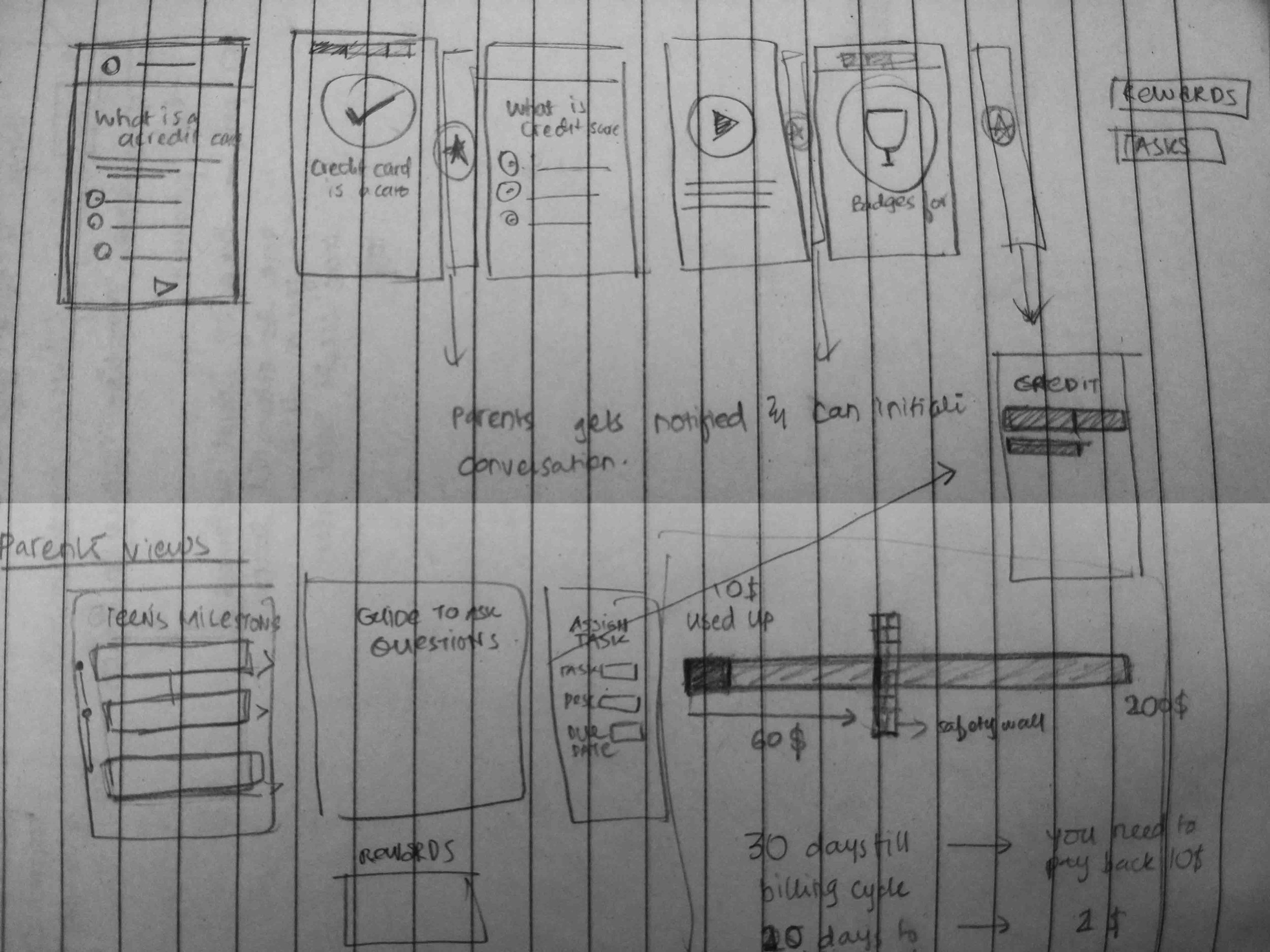

- Wireframing

- Visual design

Tools used

- Sketch

- Adobe Photoshop

Project Summary

Why is this a problem?

- Most Teenagers are financially illiterate because of lack of guidance from parents and parents don't know how to teach their kids this complex subject.

- Financially literacy is a serious social problem in the United states especially true in case of literacy about credit card and the statistic below proves it.

statistic revisited in the design process section later in the project.

How CAN we fix this?

- Parents already have a trust relationship with their children and most parents practice financial literacy in their daily lives.

- Leverage these points to create a guided tool for parents to help their kids practice financial literacy and let teenagers get hands-on-practice early on practice to understand complex terms.

OUR SOLUTION

A service that uses a mobile application to simulate the real credit card system by letting teenagers borrow money from parents and paying them back by doing chores.

HOW IT WORKS

Wilbur's working model is simple

- Teenager requests money on the app for something they want to buy from parents

- They sit with their parents to discuss how they can pay back the money and set it as task on the app.

- When they complete the task, their parents approve it and they get virtual currency in their app

- They do this over the month repeatedly and then receive a credit score with which they can unlock deals

And this is how the screens align with the task flow

Project Details

The Client- PNC BANK

PNC Bank identified teenagers as a remunerative population. They approached CMU to help create a financial literacy service to tap them as the future potential customers.

INVESTIGATION

We started exploring the entire space of teenagers and financial literacy by

- Conducting interviews with parents and teenagers,

- Reading literature and papers about the subject of financial literacy amongst various age groups,

- Analyzing games, mobile apps, videos that have solutions in the space of financial literacy for young adults

- and understanding the various stakeholders and their value exchange through a stakeholder map

THE CHALLENGE

During the investigation, we across a paper by John Zimmerman's paper titled "Teens, Parents and Financial literacy". Shown below is one of the most startling finds that came from it. It was this fact that set the foundation for Wilbur.

snowball effect of credit card DeBT

- The problem at starts with "what is credit?", i.e teenagers not understanding how the entire credit card system works.

- They go to college and get offers from banks to sign up for a credit card

- They spend without understanding which causes low credit score therefore resulting in high interest rate

- The cycle goes on and on and causes a rapidly increasing credit card debt.

Mission statement

Teach about credit card system to teenagers by using parents as the means of communication.

WHY PARENTS as means of knowledge?

Through our interviews we started seeing patterns in the parent and their children's relations.

- Parents practice financial transactions everyday and have basic literacy to teach their children and also relevant to their social economic background.

- Parents already have a trust system built with their children

These 2 factors make them the perfect candidate for helping transfer relevant knowledge to their children. All the parents also really wants to spend quality time with their children.

Using the interviews and the research insights we built personas to keep us focused on the needs of our users while designing the service

MORE RESEARCH INSIGHTS

Designing the Screens INTENT

Screen intent informed by research

1. Parents don’t know how/ WHAT to teach teenagers about finances.

Wilbur uses a structured learn-by-doing model so that the teenager can buy and pay back while becoming more responsible with the spending with each cycle because of the use of credit score and using simple metaphors to teach the concepts.

2. Parents want to find quality reasons to talk to their teenagers.

Parents and teens are required to collaborate and come together to decide on things like how much amount can be borrowed and what tasks need to be done.

3. Parents don’t know how exactly to talk to their teenagers

Teenagers have rebellious tendencies and hence when the app detects that they are overspending, it send their parents tips on how to talk to their teenagers about this.

Teenagers don’t have constant income.

The app uses virtual currency and paying back in chores because teenagers don't have a constant flow of income to use this application with real money.

Teenagers want to constantly buy things.

Using this natural tendency to leverage healthy behavior. If teenagers want to unlock deals with their favorite products, they will have to spend wisely and increase their credit scores in order to reach them.

SCREEN FLOW

UNDERSTANDING THE ENTIRE APP IN DETAIL

Sydney's friends are using the new PNC app, Wilbur.

Sydney also wants to be prepared for her adult life.

Sydney's mom also thinks that Wilbur will help Sydney learn about credit cards and personal financing.

They download the parent and teen version of the app together.

Sydney starts with a 600 credit score that can improve or worsen based on her spending and paying back habits, just like in real life.

Sydney wants to buy a prom dress.

She sends a loan request to her mom.

Sydney's mom approves the buying request and money gets deducted from Sydney's Wallet

Her mom buys the dress for her.

They sit together and discuss what task Sydney can do to repay the money and decide an amount for the task

Sydney's mom suggests taking garbage out for 3 days for 10$.

Sydney agrees and completes the task.

The money for the task gets added to her wallet. She uses it to payback her debt.

At the end of the month, her credit score is calculated. Sydney paid all her bills on time and her score rise to 700.

She unlocks deals with some of her favorite stores that have partnered with Wilbur.

Sydney continues to buy things, but in a responsible informed manner.

On her 18th birthday, Sydney receives her own credit card. She is so excited to go to college and is looking forward to her responsible financial life.

SERVICE STRATEGY

The Wilbur Service Blueprint marks the steps that will be carried out by the parents and Teenagers as well as how the third party services integrate into the design and what are the backend and frontend services offered from PNC through Wilbur

How will we retain our stakeholders?

Teens

Buy more things

Teens are always interested in buying things and the application helps them buy them, only in a more educated manner.

Discounts on popular brands/services

Discounts from third party services based on performance credit score.

Owning a credit card

Almost all the teenagers we interviewed we super excited about owning their own credit card. Wilbur rewards students who sign up for the app and pass a certain credit score with their own credit card.

Better future credit score

Starting early means better credit history leading to better credit score and thus lower interest rates in the future.Gaining financial independence from an early age.

Better banking services

Better service from banks because of constant use and good history.

Parents

Quality conversations

Being able to spend time with their teens and having quality conversations is one of the biggest gains for parents who often mention how hard it is to spend time with their children.

Sense of Relief

A sense of relief that their children will be financially responsible and independent at an early age.

Better banking services

Better service from banks because of constant use and good history.

PNC Bank

Loyal customers

Base of loyal and financially educated customers, thus fewer outstanding debts.

Better business

Increase in credit card sales because a huge long term profit for banks. These will also be sales to educated customers who WILL pay their debts. Guaranteeing profit.

More loans

More educated loans and mortgages from teens in their future for buying houses, cars, businesses etc.

CONCLUSION

Learnings

- A good service always creates value for all the stakeholders in the service.

- Service design means being able to thing of not just the product but the on boarding and more importantly a successful transition at the end of the service.

If we had more time

Since this was a fast faced project, PNC wanted us to think of the entire service and not focus too much the details like UI design. If there was more time, we would have liked to,

- Created a more refined version of the product ( with proper navigation and details in UI)

- Tested the final prototype

- Created more iterations

- Conducted a diary study with parents and teenagers to see the effectiveness of the service in a small sample