Increasing Teen Financial literacy about credit cards with PNC bank

Team Size

5 members

Duration

9 weeks

Role

Design Lead and Researcher

Skills

- Service Blueprint

- Stakeholder mapping

- Modelling

- Storyboarding & Speed-dating

- Wireframing

- Visual design

Tools used

- Sketch

- Adobe Photoshop

The Client

PNC bank approached the Service Design class of ‘17 at CMU to design a service for them that would help increase financial literacy amongst American teenagers.

THE CHALLENGE

While exploring the area of financial literacy, we across a paper by John Zimmerman's paper titled "Teens, Parents and Financial literacy". Shown below is one of the most startling finds that came from it. It was this fact that set the foundation for Wilbur.

Our Solution

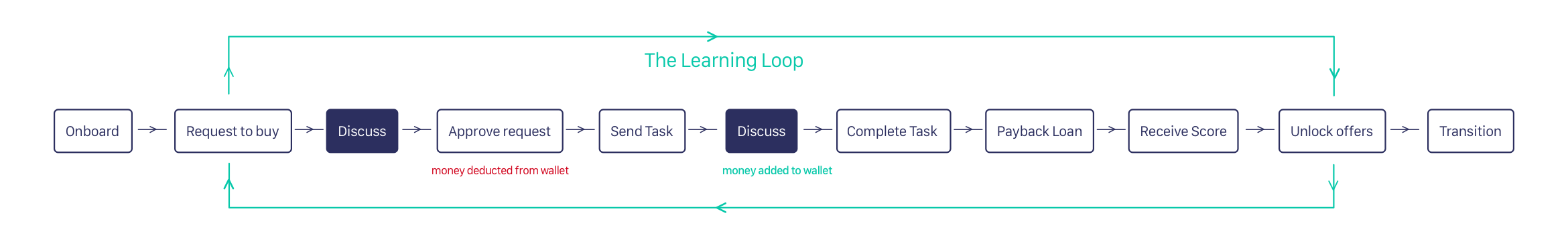

Wilbur is a service that teaches teenagers about credit cards and credit scores through a mobile app. The app simulates the real credit system by borrowing money from parents and paying them back by doing chores. It targets 3 key stakeholders, parents, teenagers and PNC Bank.

The app facilitates financial conversations with their parents which we found was one of the biggest reasons for a lack of financial literacy amongst teenagers.

Target demographic

14-16 year old American teenagers and their parents.

This audience was chosen as the most effective one for a Wilbur intervention since it gave enough time (two years) for them to learn and practice their knowledge before entering college and using an actual credit card. They were also most enthusiastic in gaining financial independence while at college.

HOW DOES WILBUR WORK?

Sydney's friends are using the new PNC app, Wilbur.

Sydney also wants to be prepared for her adult life.

Sydney's mom also thinks that Wilbur will help Sydney learn about credit cards and personal financing.

They download the parent and teen version of the app together.

Sydney starts with a 600 credit score that can improve or worsen based on her spending and paying back habits, just like in real life.

Sydney wants to buy a prom dress.

She sends a loan request to her mom.

Sydney's mom approves the buying request and money gets deducted from Sydney's Wallet

Her mom buys the dress for her.

They sit together and discuss what task Sydney can do to repay the money and decide an amount for the task

Sydney's mom suggests taking garbage out for 3 days for 10$.

Sydney agrees and completes the task.

The money for the task gets added to her wallet. She uses it to payback her debt.

At the end of the month, her credit score is calculated. Sydney paid all her bills on time and her score rise to 700.

She unlocks deals with some of her favorite stores that have partnered with Wilbur.

Sydney continues to buy things, but in a responsible informed manner.

On her 18th birthday, Sydney receives her own credit card. She is so excited to go to college and is looking forward to her responsible financial life.

The Service

Wilbur starts the on boarding process in schools by selecting a few teenagers who are chosen as the first users within that school. These students are chosen on the basis of merit or skills eg. Student club treasurer or maths club champion etc. Word of mouth and campaigning by PNC between peers is targeted as teenagers react best to their peers.

Building habits and reinforcing the knowledge of anything learnt newly requires repeated behaviour. The task has to be done over and over again in order to completely imprint the learning in your brain. Wilbur makes a teenager want to repeat the process everytime by tapping into a teenagers biggest craving, “buying things”.

Wilbur helps teenagers learn responsible spending habits by doing thing over and over again, at their own will.

How did we arrive at the solution?

UNderstanding the stakeholders

Stakeholder mapping

The stakeholder map showed us how each of the stakeholders influenced each other and what was the value exchange between them. It also helps spot the exact region that has a breakdown and needs design intervention. For example,

You can see here that teenagers and banks have absolutely no connection. The connection is broken because banks are connected directly only to parents & the lack of communication between parents and teenagers causes loss of information exchange.

Understanding the current system

Understanding credit card debt problem

Currently, college-going teenagers (first-year students receive roughly eight credit card offers in their first week) [2] are approached by banks with offers to sign up for a credit card.

This causes a rapidly increasing snowball effect where the teens sign up for a credit card (or several),

don’t understand the concept, don’t pay their credits, take high credits, lower their credit scores and jeopardize their student loans, mortgage etc. leading to an extremely high interest rate and ultimately causing bankruptcy.

Understanding The users

Interviewing parents and teenagers

We recruited eight families and engaged them in interviews involving at least one parent and at least one teen. These interviews focused on understanding how parents and teens interacted around financial choices and on how teens gain an understanding of financial topics.

It was interesting to see how each parent was so different other parents and the same for teenagers. Parents varied from being overly protective of their children with regards to finances or believing in "making-it-rough"

SYNTHESIS

Insights from Research

CONCEPTUALISATION

How Insights informed Design

Some other insights that we gained from interviews and speed dating that were highly influential in the design of Wilbur were,

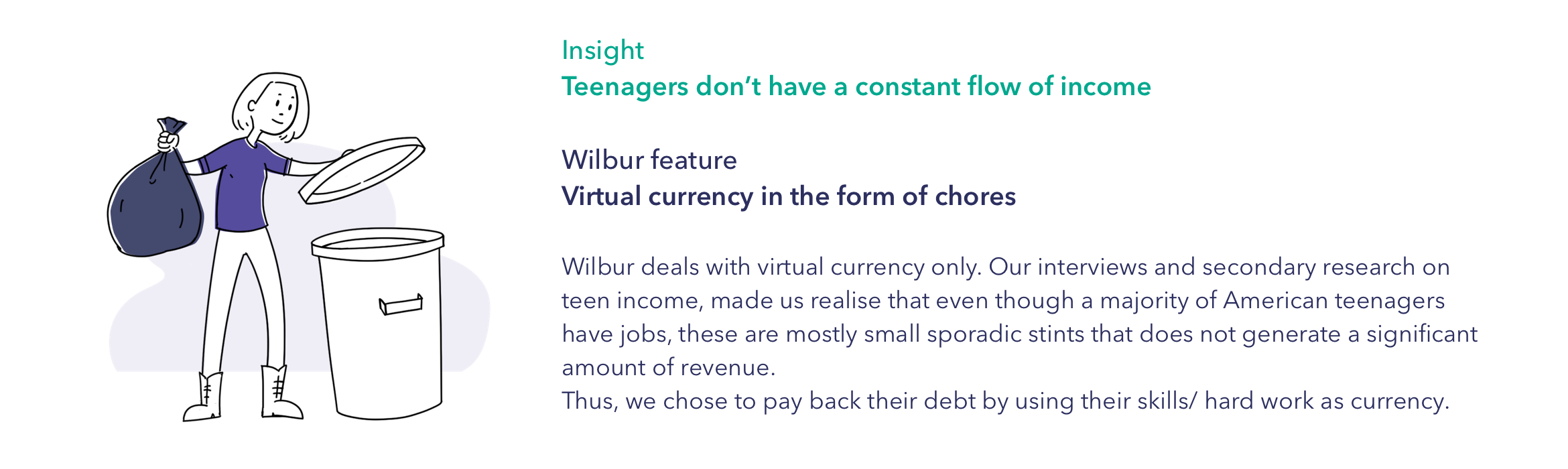

Why virtual currency?

Our interviews and secondary research on teen income, made us realise that even though a majority of American teenagers have jobs, these are mostly small sporadic stints that does not generate a significant amount of revenue.

The amount is also too small to allow any major investment and is only good enough as a source of pocket money for everyday expenses like coffee, movies, clothes etc. Thus, an alternate way of paying back their debt would be to use their skills/ time/ hard work as a currency.

Advantages of virtual currency

Value of money

By exchanging their time and hard work in place of actual currency, teens realise how much it takes pay back even small amounts in loan, thus making them appreciate the value of money.

No financial discrimination

Having no real money involved in the applications means that the app can be used by parents and teenagers regardless of their income or financial background.

Increased interaction

Parents and teens need to discuss and set every activity in the application together. From setting the borrowing amount to setting tasks and how much the tasks will be worth, everything creates a meaningful fun activity for both parents and teenagers.

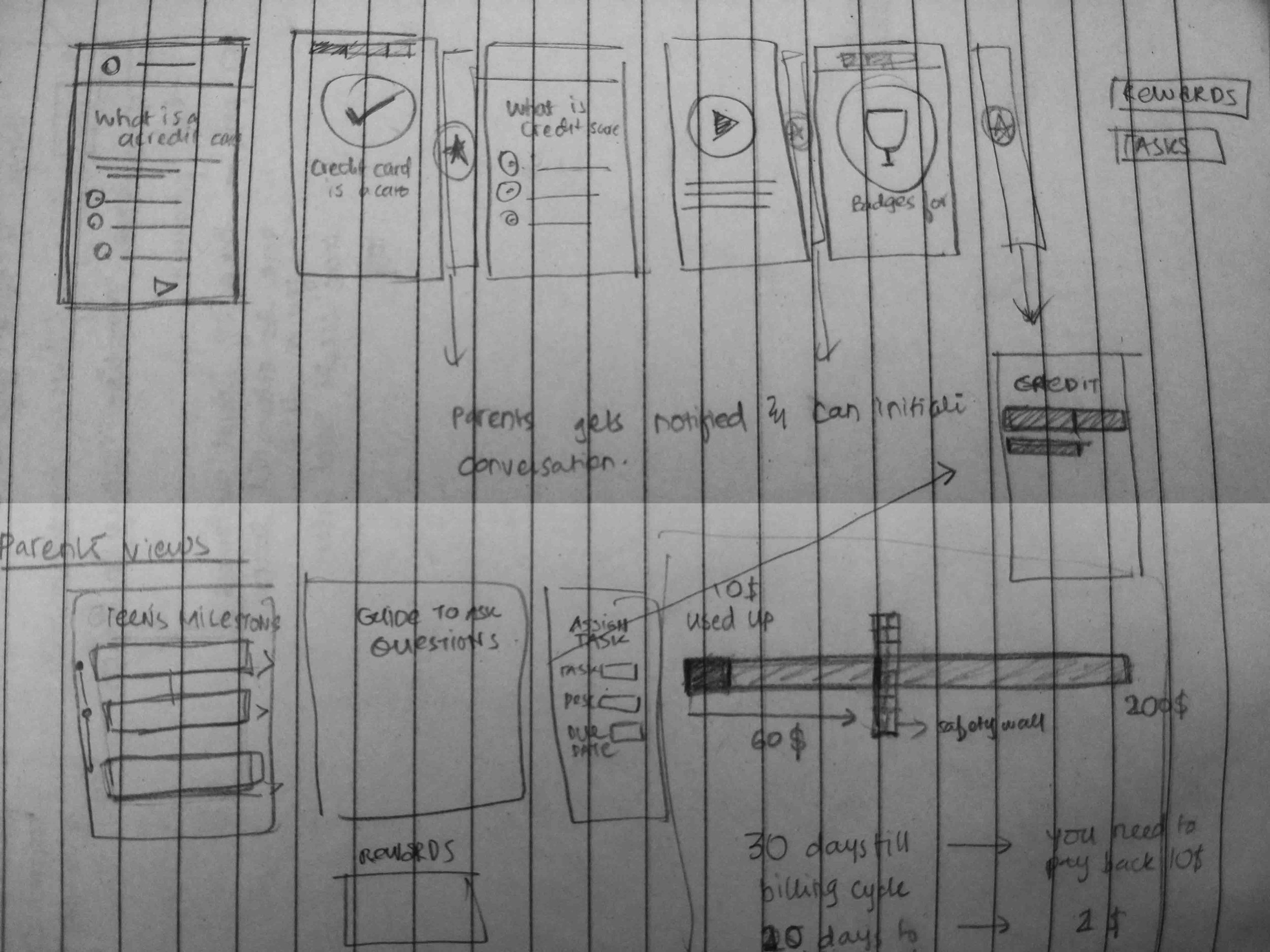

DESIGNING

Designing the product prototype

Select Screen Flows

Things I would Change

As mentioned before, the screens designed for the application were a very tiny part of the entire class. The screens designed right now can be passed as a first draft and I see they require a lot more work if this has to actually be taken forward. I would like to user test the screens with teenagers and parents and improve them to make the information hierarchy clearer and also to build a clear site map to make sure all the features are easy to access.

SERVICE STRATEGY

How will we retain our stakeholders?

Teens

Buy more things

Teens are always interested in buying things and the application helps them buy them, only in a more educated manner.

Discounts on popular brands/services

Discounts from third party services based on performance credit score.

Owning a credit card

Almost all the teenagers we interviewed we super excited about owning their own credit card. Wilbur rewards students who sign up for the app and pass a certain credit score with their own credit card.

Better future credit score

Starting early means better credit history leading to better credit score and thus lower interest rates in the future.Gaining financial independence from an early age.

Better banking services

Better service from banks because of constant use and good history.

Parents

Quality conversations

Being able to spend time with their teens and having quality conversations is one of the biggest gains for parents who often mention how hard it is to spend time with their children.

Sense of Relief

A sense of relief that their children will be financially responsible and independent at an early age.

Better banking services

Better service from banks because of constant use and good history.

PNC Bank

Loyal customers

Base of loyal and financially educated customers, thus fewer outstanding debts.

Better business

Increase in credit card sales because a huge long term profit for banks. These will also be sales to educated customers who WILL pay their debts. Guaranteeing profit.

More loans

More educated loans and mortgages from teens in their future for buying houses, cars, businesses etc.

OVERARCHING VIEW

An Indepth Overview

A service blueprint is an operational planning tool that provides guidance on how a service will be provided, specifying the physical evidence, staff actions, and support systems / infrastructure needed to deliver the service across its different channels.

The Wilbur Service Blueprint marks the steps that will be carried out by the parents and Teenagers as well as how the third party services integrate into the design and what are the backend and frontend services offered from PNC through Wilbur

CONCLUSION

Final Thoughts

Credit cards have always been looked at as a wicked problem only because people are not aware of the small rules that need to be followed to make it work in your favour. With Wilbur, we want to change this by creating fully literate teenagers who can make good use of the credit system for their benefit.